Link to the original article: https://www.cbinsights.com

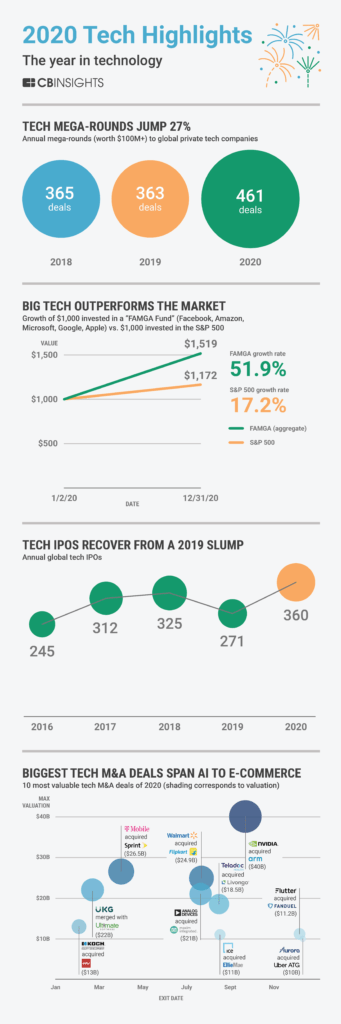

We visualize the year in tech, from a rise in mega-rounds to tech leaders’ outsized public market performance to 2020’s biggest M&A trends.

The tech industry proved its resilience in 2020. Despite ongoing economic uncertainty brought on by the global Covid-19 pandemic, the sector continued to reach new highs.

Using CB Insights data, we visualize the top-line tech industry trends for 2020, from the rise in $100M+ mega-rounds to the year’s largest M&A deals.

Please click to enlarge.

KEY TAKEAWAYS

Mega-rounds rose as investors made fewer — but larger — bets. The year saw investors consolidating their tech investments into more mega-rounds (equity deals worth $100M+) than previous years.

Across industries, VC-backed mega-rounds in the US broke records in 2020. In the global tech sector, mega-rounds jumped 27% year-over-year, reaching 461 rounds.

Some of the largest deals of the year included:

- $1.6B tranche of Series E funding to China-based online learning platform Zuoyebang (backed by Alibaba Group, SoftBank, Tiger Global Management, and others)

- $1.5B private equity round to North Carolina-based video game developer Epic Games (backed by Baillie Gifford, Lightspeed Venture Partners, T. Rowe Price, and others)

- $1.2B tranche of Series F funding to Indonesia-based on-demand app Gojek

- $856M Series I to Singapore-based super app Grab (backed by Mitsubishi UFJ Financial Group and TIS INTEC Group)

Big tech outperformed the market average. In aggregate, the subset of FAMGA companies (Facebook, Amazon, Microsoft, Google, and Apple) outperformed the S&P 500.

A theoretical “FAMGA fund” would have grown at a rate of 51.9% — more than 3x the 17.2% growth rate of the S&P 500. Of these 5 big tech leaders, Apple stock saw the highest growth in 2020, at 81%.

With a flurry of activity in H2’20, tech IPOs recovered from a 2019 slump. In spite of pandemic-driven uncertainty, 360 tech companies took the leap into public markets in 2020 — up 33% from a tech IPO slump in 2019.

While quarterly tech IPOs dipped at the start of the pandemic, they rallied in the later half of the year as companies regained confidence, with more than 70% of 2020 IPOs taking place in H2’20.

Major IPOs from the year included insurtech upstart Lemonade (debuted in July), cloud data warehouse provider Snowflake Computing (September), and organizational tool Asana (September), as well as huge late-in-the-year IPOs by DoorDash and Airbnb (both in December).

The largest M&A deals spanned computing, telehealth, and fantasy sports. The biggest M&A round of the year was Nvidia’s $40B acquisition of chip designer Arm, followed by T-Mobile’s $26.5B purchase of telecom provider Sprint and Walmart’s $24.9B corporate majority stake in India-based e-commerce company Flipkart.

Computing and cloud capabilities were a trend among the year’s largest tech M&A deals, including Nvidia’s acquisition of Arm, Analog Devices’ purchase of chipmaker Maxim, and Koch Equity’s expansion of its stake in Infor.

Other leading deals highlight trends brought into focus by the pandemic. Teladoc acquired Livongo Health with an eye toward telehealth and remote care, while Flutter Entertainment’s purchase of FanDuel is a bet on fantasy sports at a time when in-person sports are less available. And although the deal took place in February, Kronos and Ultimate Software’s merger to become Ultimate Kronos Group (UKG) points to the prominence of HR solutions in a new, more remote era of workforce management.