Link to the original article: ‘Tourist’ investors haven’t fled VC, but there are signs of a tactical retreat

Corporate venture arms, hedge funds, private equity firms and other nontraditional investors have rushed into venture over the last few years. Their participation, which reached over 78% of total US VC deal value in 2021, according to PitchBook data, was credited with driving up deal prices across the venture industry.

Now, many of these investors—especially crossover firms that invest in public and private companies—are starting to retreat from VC-backed startups amid high stock market volatility and increasing interest rates.

A nontraditional peak?

VC deal activity with nontraditional investor participation

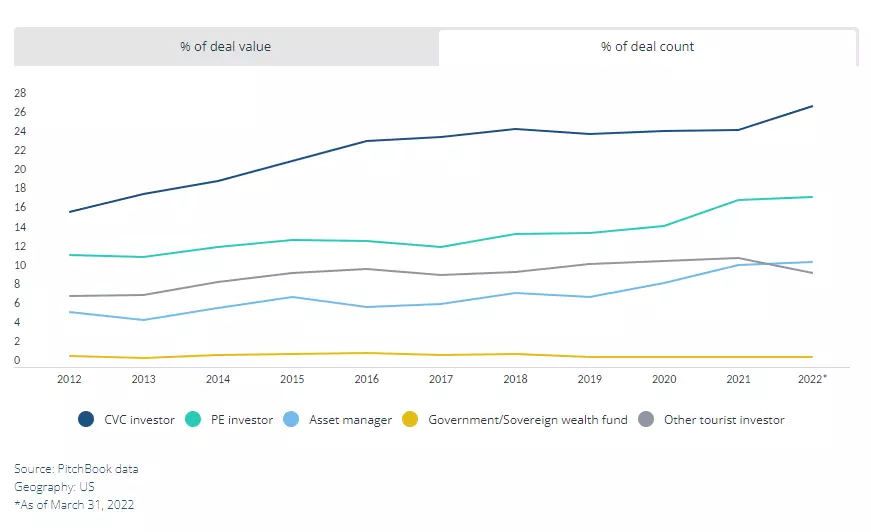

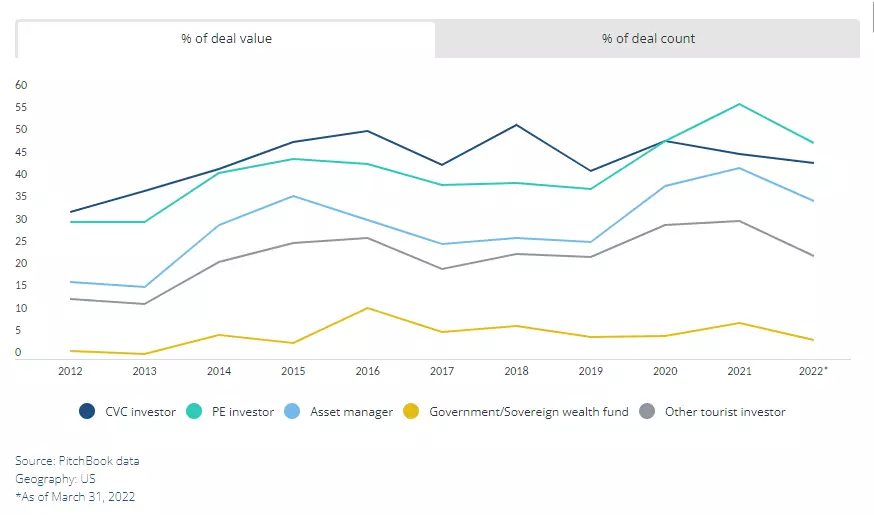

Nontraditional investor participation as a proportion of VC deals

In the first three months of 2022, nontraditional investors participated in $52.5 billion worth of deal value, less than in any quarter of last year, according to the latest PitchBook-NVCA Venture Monitor.

But their pullback from venture capital is primarily an aversion to larger late-stage deals, not VC overall. In Q1, these investors participated in the largest deal count on record, according to a PitchBook estimate.

For some investor types, the retreat has been more pronounced. Private equity firms as well as asset managers like hedge funds showed the highest pullback from VC, as measured by their participation rate in VC deals by value.

“I think all the crossover hedge funds basically disappeared from the private markets,” said Mitchell Green, founding partner at Lead Edge Capital, a growth equity firm.

Since there is generally a lag between term sheet-signing and deal announcements, it may take a few more months to see how nontraditional investor activity has changed, said Kyle Stanford, a senior analyst at PitchBook.

Sometimes called tourist investors, nontraditional investors are defined as institutions that don’t typically have roots in venture capital. They include asset managers, hedge funds, private equity firms, sovereign wealth funds and corporate venture capital.

“We would expect NTIs to become more cautious broadly, which would translate into slower deal activity than 2021,” Stanford said. He added that unless there is a significant economic downturn, CVC firms, which invest in venture for strategic reasons, should retreat less than other investor types.

Related read: PitchBook-NVCA Venture Monitor

Featured image by Andriy Onufriyenko/Getty Images