Link to the original article: https://www.cbinsights.com/research/report/amazon-disruption-industries/?utm_source=CB+Insights+Newsletter&utm_medium=email&utm_campaign=newsletter_general_sat_2022_03_12&utm_term=block-1&utm_content=research-public

Since 1999, Amazon’s disruptive bravado has made “getting Amazoned” a fear for executives in any sector the tech giant sets its sights on. Here are the industries that could be under threat next.

Throughout the 2000s, Amazon’s e-commerce dominance paved a path of destruction through books, music, toys, sports, and a range of other retail verticals. Big box stores like Toys “R” Us, Sports Authority, and Barnes & Noble — some of which had thrived for more than a century — couldn’t compete with Amazon’s ability to combine uncommonly fast shipping with low prices.

Today, Amazon’s disruptive ambitions extend far beyond retail. With its expertise in complex supply chain logistics and competitive advantage in data collection, Amazon is attacking a whole host of new industries.

The tech giant has acquired a brick-and-mortar grocery chain, and it’s using its tech to simplify local delivery, such as machine vision-enabled assembly lines that can automatically sort ripe from unripe vegetables and fruit.

In June 2018, it acquired the online pharmacy service PillPack. Now, it’s building out a nationwide network of pharmacy licenses and distribution with its Amazon Pharmacy product.

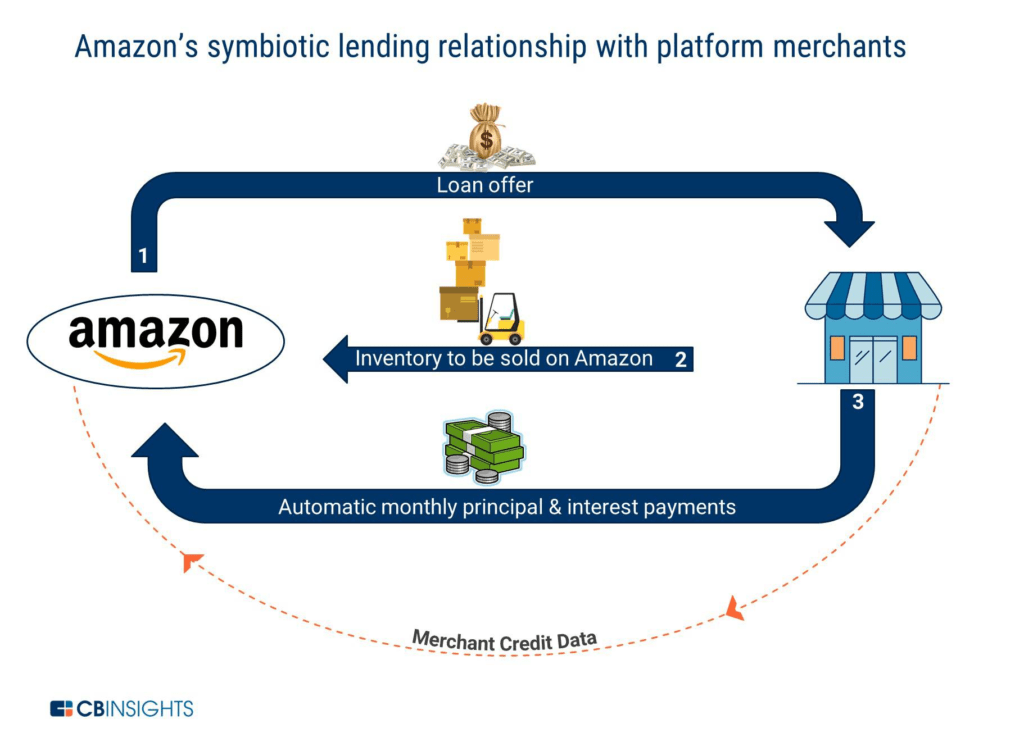

On its own Amazon Marketplace, the company is using its sales and forecasting data to offer de-risked loans to Amazon merchants at better interest rates than the average bank.

The tech giant saw a huge boost from the Covid-19 pandemic, as more consumers were shopping online and staying at home — Q3’20 profit hit $6.3B, up 200% from Q3’19. Although Q3’21 profits dipped to $3.2B, Amazon still has the spending power to tackle new industries.

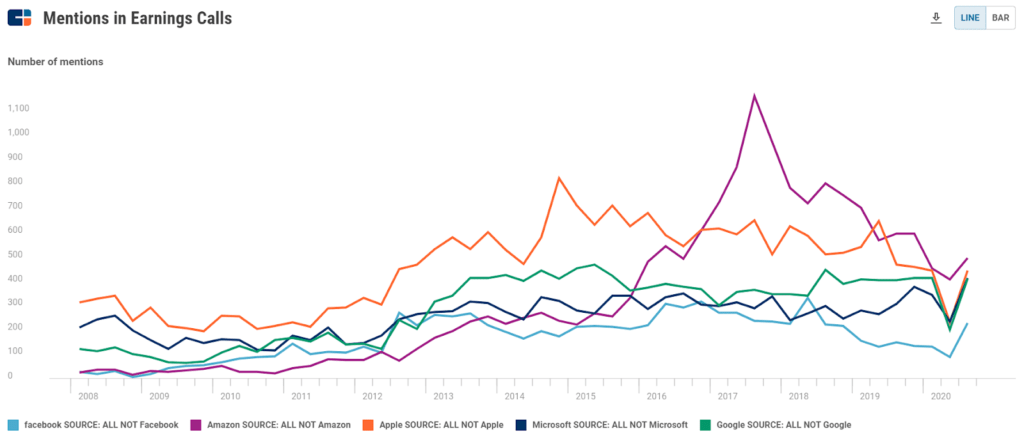

On calls with investors, executives of public American companies mentioned Amazon more often than they mentioned any other big tech company.

We researched the 5 industries where Amazon’s disruptive intentions are clearest today — pharmacies, small business lending, logistics, groceries, and payments — as well as 7 industries where Amazon’s efforts are more nascent. The disruptive possibilities in these industries — home & garden, insurance, smart home, and luxury fashion — remain speculative for now, but with Amazon’s scale and advantages, they could soon be a reality.

Below, we lay out the case and the progress that Amazon has made thus far.

TABLE OF CONTENTS

-

- The 5 industries Amazon will disrupt in the next 5 years

- Pharmacies: Making drugs a low-margin commodity

- Small business lending: A direct, data-driven source of financing

- Fulfillment & delivery: Using the AWS model to create a new business line

- Online groceries and digitized stores: Changing the way customers grocery shop

- Payments: Giving small merchants a cheaper option

- The 5 industries Amazon will disrupt in the next 5 years

-

- The 7 industries Amazon could go after next

- Insurance: Bundling value into the shopping experience

- Luxury goods and services: Bringing high fashion online and digitizing beauty salons

- Brick-and-mortar retail: Launching Amazon Style

- Smart home: Racing to connect the whole house

- Home & garden: Capitalizing on supply chain expertise

- Media & entertainment: Expanding into the gaming and audio markets

- Handcrafted goods: Amazon Handmade takes on Etsy

- The 7 industries Amazon could go after next

The 5 industries Amazon will disrupt in the next 5 years

1. Pharmacies: Making drugs a low-margin commodity

Pharmacy chains like Walgreens and CVS have already seen their retail revenues suffer from the rise of Amazon’s convenient “everything store.” Today, they have a new challenge: in addition to disrupting their “front of the store,” Amazon is angling to disrupt their core business of drug distribution.

Amazon’s interest in disrupting the drugstore is decades old. In 1999, Amazon bought 40% of Drugstore.com (at the time, a pre-product and pre-revenue company). Bezos would later hire its CEO, Kal Raman, to run hardlines (retail products which are hard to the touch) at Amazon.

Amazon proceeded to lay low in the pharma space until 2016 when Amazon reportedly received its first licenses to sell pharmaceutical products and drugs from various state boards across the United States.

In 2018, Amazon made another move towards gaining a footing in this notoriously complex and highly regulated space: it acquired PillPack in a deal worth around $750M.

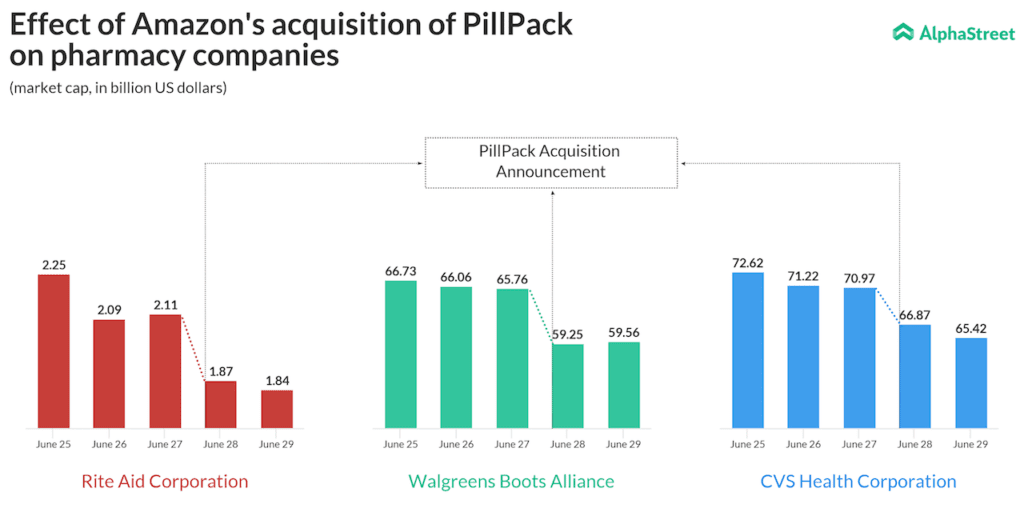

Source: AlphaStreet

The PillPack purchase was Amazon’s first significant move not just against the major drug store chains, but against the powerful pharmacy benefit managers (PBMs) that manage the dispensation of drugs for major employers, and others in the healthcare supply chain.

Amazon’s acquisition of a business with pharmacy licenses in all 50 states caused the tickers of Walgreens, CVS, and Rite-Aid to lose about $11B in value overnight.

However, the Covid-19 pandemic increased the need for streamlined medication delivery and ramped up the competition between large drug stores and Amazon in the short term.

Though Amazon has an advantage in its logistics and delivery capabilities, it may need to speed up its pharma initiatives before existing pharmacies and pharmaceutical companies catch up.

WHY AMAZON IS GOING AFTER PHARMA

When it comes to pharmaceuticals, there are several reasons that Amazon — and its direct-to-consumer model — could be a good fit in the industry.

Convenience: The process of filling a prescription at a typical brick-and-mortar pharmacy is often inefficient and time-consuming, and the pandemic has prevented at-risk patients from accessing pharmacies. Amazon’s model aims to limit the effort patients need to expend while also getting prescriptions to them within a day or two.

Customer experience: Complaints from users of specialty pharmacies about errors, delays, confusing policies, and poor customer service have been common for years. Amazon’s advantage here comes in its 2 decades of e-commerce logistics experience — this could help avoid delivery mistakes, a vital consideration for serving people with complex medication needs.

Partnerships: Amazon’s healthcare partnerships could provide a large web of beta testers for new healthcare products. Amazon had been working with holding company Berkshire Hathaway and investment bank JPMorgan on Haven, a joint venture aiming to streamline healthcare for their employees. However, the project was shut down in February 2021 after challenges with gathering data due to employee healthcare costs, employee turnover within the project, and unclear goals. Amazon has since announced a new partnership with pharmacy benefit manager Prime Therapeutics. Prime’s Blue Plan members will be able to receive their medications via delivery through Amazon Pharmacy.

Pre-existing customer base and distribution capabilities: The Covid-19 pandemic has made fast and dependable medication delivery a necessity for pharmacies. CVS and Walgreens now offer free 1- to 2-day delivery from a local pharmacy, and CVS also provides same-day delivery for a fee. But with more than 200M Prime subscribers worldwide — conditioned to expect free, fast delivery on virtually any good — Amazon will likely be placed to offer better distribution than CVS or other pharmacy chains.

Physical stores: When Amazon acquired Whole Foods in 2017, it also acquired around 450 physical locations where it could theoretically dispense prescriptions the same way that CVS and Rite Aid do. These stores could serve as hubs for medication delivery, similar to how Amazon currently offers same-day Whole Foods grocery delivery. Recent reports also indicate Amazon is exploring rolling out brick-and-mortar pharmacies in its Whole Foods locations. Although there are no definite plans yet, the news triggered a drop in shares of competing drugstore chain operations like Walgreens and CVS Health.

Amazon has also opened several Amazon Fresh locations in the US. These stores are more like conventional grocers, and could contain pharmacies — either for in-store prescription pickup, or as hubs for a local delivery service.

Streamlined distribution: Amazon’s ambitions in pharmacy may not end at just delivering drugs.

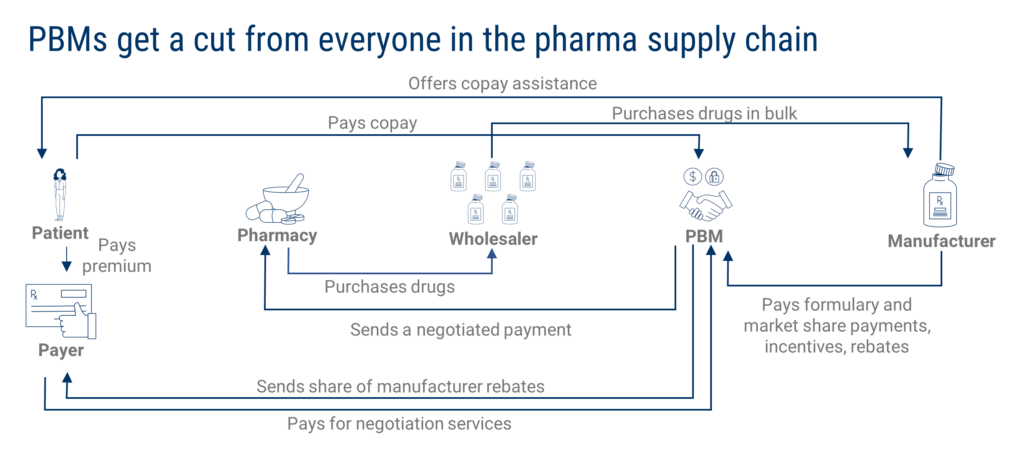

The pharmaceutical supply chain involves all kinds of middlemen, each of whom takes a slice of profit as drugs make their way from the manufacturer to the end-patient user — the kind of messy business model that Amazon has special expertise in disrupting.

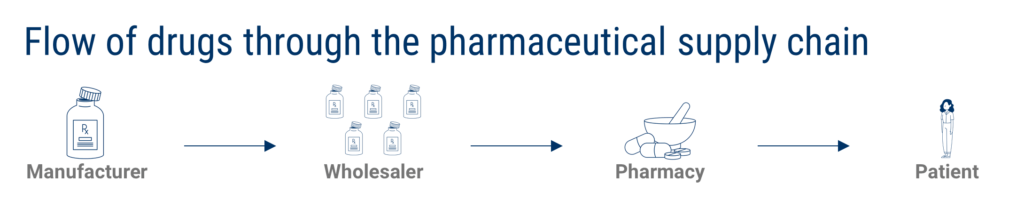

In broad terms, patients pay pharmacies for drugs, which pay wholesalers, which in turn pay manufacturers or distributors.

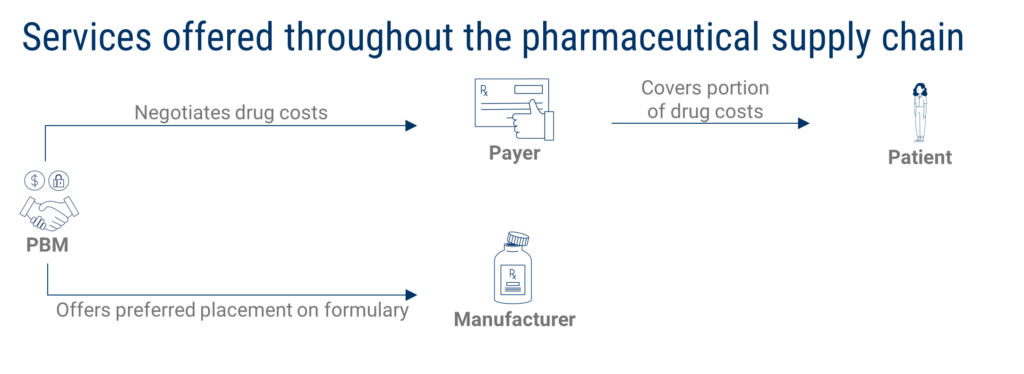

But there are additional layers that make the supply chain more complex. Pharmacy benefit managers (PBMs) negotiate with distributors and manufacturers for better prices on bulk drugs — a service they offer to payers (insurance companies). They also receive a copay from individual patients and get paid by manufacturers to market their drugs to payers.

Among the different middlemen, PBMs make the lion’s share of the profit from your typical drug transaction. On the sale of a drug with a sticker price of $100, the profit breakdown is roughly:

- Wholesaler: $1.00

- Pharmacy: $5.00

- PBM: $6.00

Virtually every insurance provider outsources its drug procurement to a pharmacy benefit manager. Most major employers use PBMs as well to help negotiate for better rates on drugs for their employees.

PBM’s core advantage is that they collect from every party along the pharmaceutical supply chain. They increase their margins, while end patients pay higher drug costs because of how complex and inefficient the process is.

In the long-term, Amazon’s skill set and scale could give it the power to disrupt and simplify this supply chain — first in the form of pharmacies themselves, and later, by targeting wholesalers and PBMs.

For more on this topic, check out our research brief on the pharmaceutical supply chain.

HOW AMAZON IS GOING AFTER PHARMA

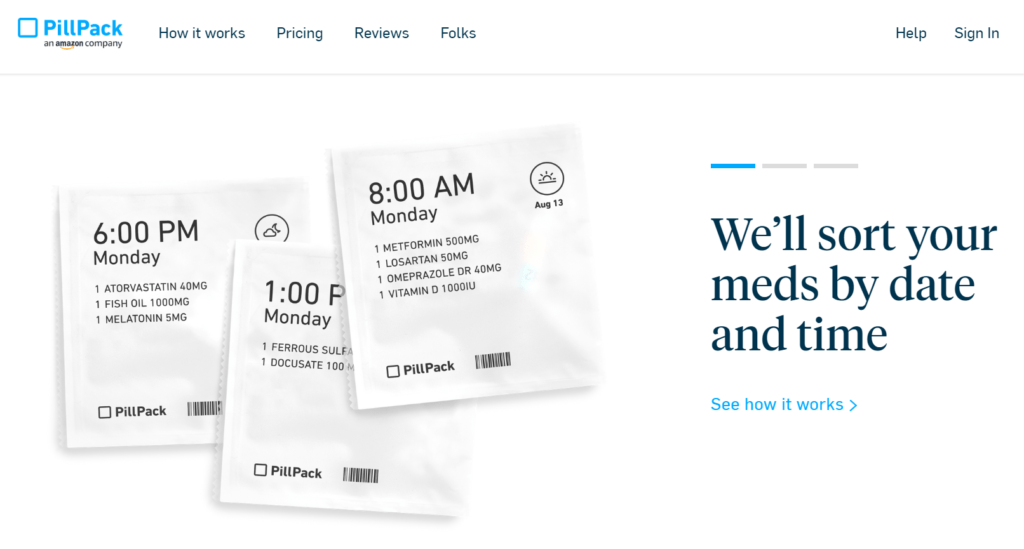

Amazon took its first major step in the pharmacy space when it acquired the online pharmacy PillPack for around $750M in 2018 and later rebranded the company to PillPack By Amazon Pharmacy.

PillPack delivers users’ medications directly to their homes. Notably, the company sends pills in pre-sorted pouches to be taken at specific times of the day. In addition to sending medications, PillPack includes info sheets that list when to take each medicine, when the current batch of prescriptions will run out, when to expect the next shipment, and more.

The PillPack user experience is designed to be clean, simple, and more intuitive than traditional pharmacies. Source: PillPack

In November 2020, Amazon announced that it was further expanding its pharmacy delivery business — the company launched Amazon Pharmacy, which allows customers to order prescription medications and offers free delivery and prescription discounts for Prime members. The offering relies on PillPack’s pharmacy software and fulfillment centers.

But Amazon Pharmacy does have its cons. For example, the service doesn’t ship Schedule II medications. Though it accepts some insurance, the highest discounts and long-term medication supplies are available to cash patients, which limits the scope of customers Amazon can attract. The senior director of health care industry research at Gartner, Kate McCarthy, told Advisory Board she sees Amazon Pharmacy as being more focused on increasing the company’s connection with the American household rather than discounts.

Down the road, Amazon may further leverage its tech to expand its healthcare presence. In 2019, Amazon’s voice assistant Alexa added its first HIPAA-compliant skills, including allowing patients to check on prescription delivery status and reminding patients to take medications. The Alexa app platform also carries lightweight healthcare apps from institutions like Mayo Clinic and Libertana to answer simple health questions, send alerts in emergencies, and help communicate with caregivers.

In the future, these capabilities could lead to Amazon getting into the diagnosis, drug recommendation, and even the prescription side of pharmaceuticals — though that future is likely some way off.

WHO’S AT RISK?

Traditional brick-and-mortar pharmacies

Today, Amazon’s efforts in the pharmaceutical space mainly attempt to disrupt the last-mile of the pharmacy supply chain: retail pharmacies like CVS and Rite Aid.

The current process of picking up a prescription is time-consuming and inefficient, and the price that patients pay for their medicine varies based on factors like geography, insurance, and more.

In the past, retail pharmacies defended against disruption by having the most convenient and the fastest way to fill a prescription for most Americans. Amid the Covid-19 pandemic, however, prescription delivery became table stakes, with most retail pharmacies waiving their delivery fees, or offering 1-2 day free delivery or same-day delivery for a fee since many patients could not fill prescriptions in person.

But the delivery offerings come at a price for pharmacies. With its vast network of fulfillment centers and its PillPack acquisition, Amazon could offer cheaper and faster delivery, pricing out the retail pharmacies in the long run. Amazon also has footholds in the brick-and-mortar world it could eventually leverage, through Whole Foods and its Amazon Fresh grocery chain.

Pharmacy benefit managers (PBMs)

In the longer-term, Amazon could use these capabilities to take aim at one of the most lucrative — and disliked — parts of the healthcare supply chain: PBMs.

Three PBMs make up nearly 80% of the market in the US: CVS Caremark, Express Scripts, and OptumRX.

Pharmacy benefit managers are extremely lucrative businesses, with over $140B in annual revenue for CVS Health’s PBM division alone. However, they receive significant criticism due to the lack of price transparency as well as perverse incentives around how PBMs select which drugs to supply to consumers.

Amazon does not rely on pharmaceuticals to drive its profits, so it has the freedom to become a virtually non-profit approach to pharmacy benefit management — and with PillPack, it may have the growth engine required to reach PBM scale negotiating power.

With a large user base of consumers ordering drugs through Amazon, the company may be well-positioned to negotiate bulk discounts from drug distributors. This is already the operating model of companies like GoodRx and BlinkHealth. Amazon, however, would be able to leverage the largest member population in the United States to do it.

With lower costs in place and a more transparent supply chain, Amazon could become an attractive alternative drug supply partner for employers who are unhappy with the rebate-driven PBM model that contributes to high drug costs for their employees.

For more on this topic, check out our brief, Amazon In Healthcare: The E-Commerce Giant’s Strategy For A $3 Trillion Market.

2. Small business lending: A direct, data-driven source of financing

Amazon took its first steps into commercial loans back in 2011, when the company began offering small-business loans to merchants participating in its Amazon Marketplace via its Amazon Lending arm. At that time, conditions were well-suited for Amazon’s entry into the commercial lending sector: the global financial crisis of 2008 had shaken confidence in even the largest commercial banks, initiated a credit crunch, and left millions of small businesses struggling to secure the capital they needed to survive. Since then, the company has doubled down on its lending efforts.

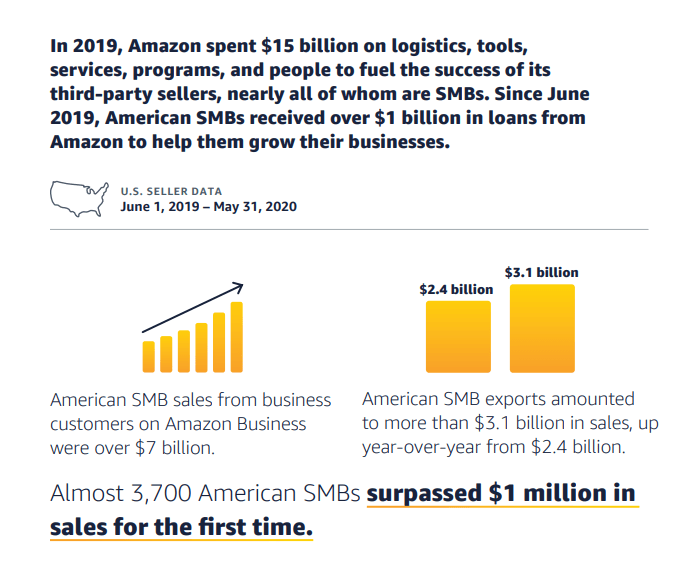

As of 2021, Amazon has 2M third-party merchants in the small and medium-sized business sector that use its platform, information on the financial health of those businesses, and the customer-first culture to build a compelling lending platform.

WHY AMAZON IS GOING AFTER SMALL BUSINESS LENDING

Over the last 2 decades, the percentage of Amazon sales completed by third-party merchants has increased from 3% to 56%. These SMBs have succeeded on the Amazon marketplace in part because Amazon has, in Bezos’ words, invested in and given them “the very best selling tools we could imagine and build.”

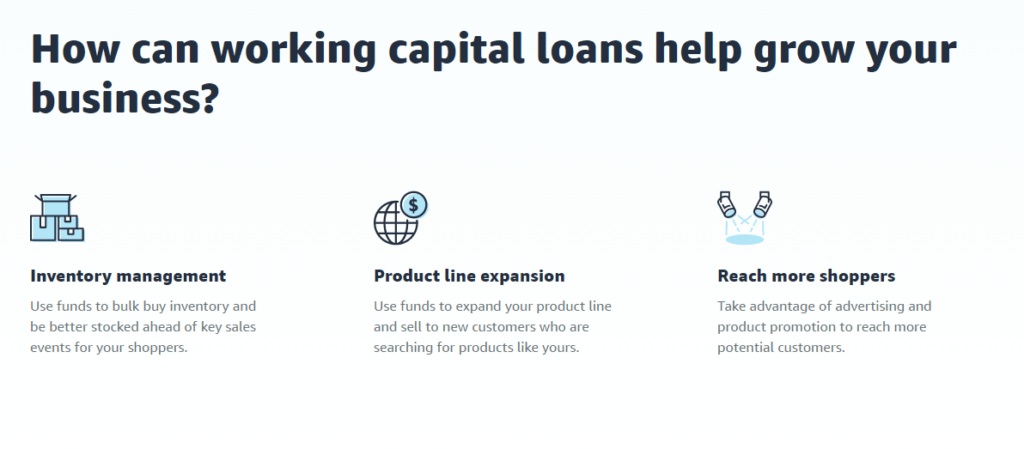

Among those selling tools today is small business financing.

Amazon Lending gives its third-party sellers access to up to $1M in loans or credit for inventory management, product line expansion, or product promotion through a partnership with Marcus by Goldman Sachs. It also provides loans to merchants through a partnership with Bank of America.

The Marcus partnership is the first time that Amazon will open up its treasure trove of sales data on its sellers to a third-party financial institution to make underwriting decisions.

Source: Amazon

Giving out loans to Amazon merchants in this growing space makes sense for Amazon: if the company can give its third-party merchants loans that go back into selling products on Amazon, it’s a win for both sides. Amazon gets the increased business, plus a cut of the interest from the loans; the merchant gets the capital it needs to grow.

Unlike traditional small business loans, Amazon automates its loan repayment process, taking the owed money out of a merchant’s Amazon sales income. And its streamlined application system — which is based on pulling metrics from a merchant’s Amazon account — makes it easier for small businesses to access financing.

Often, the aims of large financial institutions stand at odds with those of small businesses. It costs a bank a similar amount of money to process a $50K loan as it does to process a $1M loan, but the expected profit of the smaller loan is much lower. Given that credit needs for small businesses tend to be for smaller amounts, banks can see them as being less profitable opportunities.

Another challenge facing small businesses seeking capital from commercial banks is a lack of suitable collateral. Banks prefer to lend to businesses with assets, such as property or specialized equipment, that can be used to secure the loan. This puts small, online businesses at a distinct disadvantage, as these companies are much less likely to possess the kind of tangible collateral that banks often seek.

These challenges make small business loans an attractive market for Amazon to disrupt.

Amazon already has huge amounts of data on the merchants that use its platform — and subsequently doesn’t need the kind of extensive documentation required by many commercial banks. Whereas banks often rely upon credit scores and personal financial documentation to determine the risk associated with lending to a given business, Amazon already has information such as revenue history and future earnings projections, inventory data, and sales data.

The company also possesses a wealth of tertiary data about prospective borrowers, such as a business’ relative popularity within its vertical and its standard of customer service based upon Amazon user reviews — information no financial institution has. With all of this information, Amazon may be able to make better-informed lending decisions than the average commercial bank — and, as the approval system would be data driven, likely process them faster.

HOW AMAZON IS GOING AFTER SMALL BUSINESS LENDING

Today, Amazon Lending offers small business loans ranging from $1,000 to $750,000 to qualifying merchants with repayment plans of 3 to 12 months. It makes money by charging interest on the loans — the retail giant reportedly charges rates of 6% to 19.9%, within the range of the average rates from other online and alternative lenders.

“We created Amazon Lending to make it simple for up-and-coming small businesses to efficiently get a business loan, because we know that an infusion of capital at the right moment can put a small business on the path to even greater success.” — Peeyush Nahar, former Vice President, Amazon Marketplace

Merchants who wish to participate in the Amazon Lending program must be invited to do so, meaning that not every Amazon Marketplace merchant can apply for a loan. Amazon extends these invitations based on an algorithmic evaluation of a merchant’s business, from the popularity of their merchandise to their inventory cycles, among other factors — a critical calculation that helps Amazon mitigate its lending risk.

The advantage of this exclusivity is that Amazon can offer loans quickly: unlike traditional lenders that rely upon extensive documentation typically furnished by the borrower, Amazon Lending typically approves loan applications within just 24 hours. Amazon also does not charge borrowers origination fees or penalize them for prepayments. The company also paused its automatic repayments for the first few months of the Covid-19 pandemic, providing small businesses with valuable lifelines.

Despite only offering short-term loans to prequalified merchants, Amazon’s small business loans have proven to be popular. From launch in 2011 to Q1’19, Amazon reported it issued $5B across more than 20,000 businesses in the US, Japan, and the UK. In the year ending May 2020, Amazon loaned over $1B to small businesses in the US alone. In 2021, Amazon and its lending partners loaned nearly $1B to SMBs in the US.

Source: Amazon

The invite-only nature of Amazon Lending might seem exclusionary, but it allows Amazon to prequalify merchants and provide a superior experience for borrowers by streamlining the loan application process and reducing the time needed to reach a lending decision.

Amazon has also teamed up with Lendistry to launch Amazon Community Lending. The program provides loans of up to $100,000 to Amazon sellers in the US, most of which are small and medium-sized businesses (SMBs). Lendistry is especially focused on supporting minority-owned SMBs in struggling communities. The loans come with 8% to 9.9% interest rates.

Additionally, Amazon has launched lending offerings in Germany, where sellers are eligible to apply for loans of up to roughly $845,000 (€750,000) at ING Bank. Sellers can repay their loan within 3 years. In India, Amazon has partnered with ICICI Bank to allow sellers to overdraft their accounts up to ~$33,425 (INR 25 lakhs). The overdraft application process is entirely digital.

WHO’S AT RISK?

Commercial banks & local lenders

Amazon’s vast network of merchants is the perfect launchpad for a lending business.

Among these companies, Amazon has a deep competitive moat made up of data and speed — one that is difficult for commercial banks to match. With its data advantage, Amazon has the power to offer loans to businesses that traditional banks might consider lower-quality borrowers and refuse (or lend to on more onerous terms).

“Amazon has had a hugely positive impact on our business. Traditional funding vehicles wouldn’t support our model of direct to consumer and we needed help. Amazon stepped in and is a great partner for us.” — Caleb Light, VP of Sales, Power Practical

This data also means Amazon has a significant advantage in terms of the customer experience of applying for a loan, as getting a loan through Amazon is much faster than getting a loan through a bank.

Competitor e-commerce platforms

While there may be no incentive for Amazon to lend outside its own ecosystem today, the company is using its small business financing program as a means to encourage merchants around the world to leave local competing e-commerce companies and join Amazon.

Amazon’s streamlined lending system offers its merchants capital to use on buying more Amazon inventory, and in return deducts monthly payments automatically.

In September 2017, Amazon began offering loans to pre-qualified Amazon merchants in India via a partnership with the Bank of Baroda in anticipation of that year’s holiday shopping season, allowing their merchant customers to expand their inventories ahead of the crucial holiday period.

Amazon followed up its tentative steps into small business financing in India in April 2018, when the company invested $22M as part of the Series C round of SMB-focused capital finance marketplace platform, Capital Float. The company also invested in Capital Float’s $15M Series E in April 2020.

The significance of these moves is less that they promote Amazon loans to current Amazon merchants, but that they have the potential to bring new merchants into the Amazon ecosystem.

In addition to loans, Amazon can also offer the small businesses it lends to marketing opportunities, better placement within Amazon’s search results, or information about how to increase sales.

Small businesses themselves

If small businesses grow over reliant on the availability of Amazon lending, they risk a hard fall should Amazon significantly scale back its focus on SMB financing and product promotions.

From 2017 to 2021, Amazon increased the number of private label brands it sells from 30 to more than 100. These kinds of private label products provide Amazon with an obvious host of benefits, such as not having to share space and revenue with other SMB brands or spend time developing its own products.

Private labels could also increase competition for the SMBs that want to use the Amazon marketplace to sell their wares — or even lead to an unfair advantage. In India, Amazon has been accused of copying other merchants and manipulating the search engine to ensure its products are prioritized in the results. In the US, it paid $2M to settle a price-fixing investigation of the “Sold by Amazon” program, which it shut down shortly after antitrust authorities launched the investigation.

Amazon is also partnering with larger brands to sell their products on the e-commerce site, including Apple and Under Armour.

Prioritizing big name brands and private labels over small businesses would make small business lending inherently less attractive inside Amazon, and along with the numerous major risks involved, may imply that the company is walking back some of its ambitions in the space.

For more on Amazon’s financial services strategy, see our brief, Everything You Need To Know About What Amazon Is Doing In Financial Services.

3. Fulfillment & delivery: Using the AWS model to create a new business line

For Amazon, selling products is only half the battle — it’s getting those items to customers that really matters.

Fulfillment logistics is the process of storing inventory, packing customer orders, and shipping orders. To do so effectively requires significant investment in inventory tracking, fulfillment, and delivery technology.

Shipping is one of the most important and largest cost centers for Amazon. The company prides itself on rapid delivery as a way to enhance the customer experience and entice more customers to join Amazon Prime.

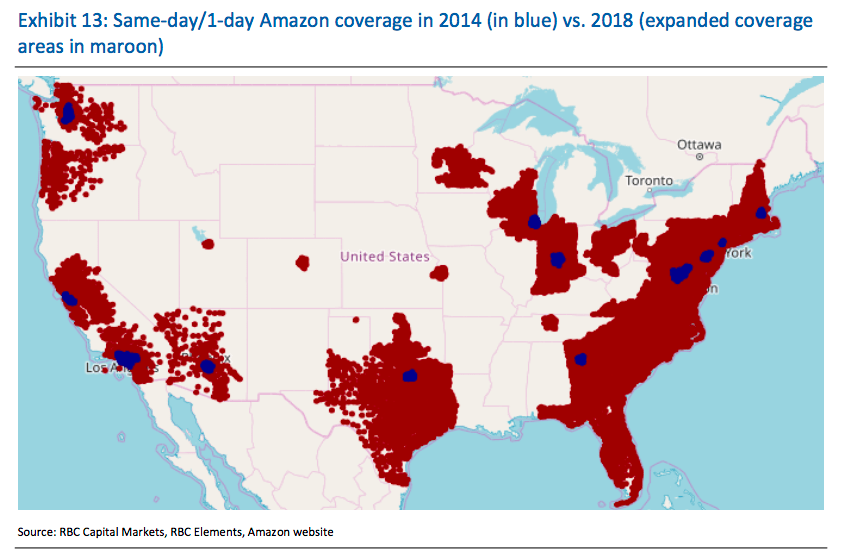

As of 2019, Amazon offered same-day or next-day shipping to 72% of the total US population, up significantly from just 4 years prior. Today, Amazon is expanding its same-day delivery services to cover a total of 12 US cities.

Source: CNBC

However, the company used to rely almost entirely on shipping companies UPS and FedEx, as well as the US Postal Service, to get shipments to customers, taking that part of the business out of its hands entirely.

Over the past decade, Amazon has been investing heavily in its logistics and delivery capabilities, trying to improve the speed and efficiency of the shipping process and reduce its reliance on third-party logistics providers. From 2014 to 2018, the company increased its logistics infrastructure in the US by nearly 3X. The infrastructure growth showed no signs of slowing down in 2020, when it expanded by 50%.

Similar to how the retailer’s largest non-retail businesses lines like AWS began as a way to make its own operations more efficient, Amazon’s logistics goals may be to own the shipping process for their own business, but could eventually turn outward to help other businesses with their logistics needs.

WHY AMAZON IS GOING AFTER LOGISTICS

Amazon spends a significant amount of money on shipping and logistics.

The company’s shipping costs totaled $53B in the first 3 quarters of 2021, including $18.1B in Q3’21 alone, up 20% YoY.

In fact, its shipping costs are increasing at a faster pace than online sales, showing how the Covid-19 pandemic has impacted the price of delivery in recent months. The company spent over $15B from 2020 through the first 6 months of 2021 on Covid-related measures like enhanced cleaning, PPE, and social distancing measures in fulfillment centers.

Though the retail giant used to rely almost exclusively on carriers like UPS and FedEx to ship their packages, Amazon now ships and delivers more than two-thirds of its own packages using Amazon Logistics. In July 2020 alone, the company shipped 415M packages.

HOW AMAZON IS GOING AFTER LOGISTICS

Amazon aims to reinvent shoppers’ expectations of what is possible for delivery, including addressing today’s pain points. The company is primarily focused on automating the delivery process, making it faster, more efficient, and more predictable.

Though Amazon has already invested significant funds into building out its fulfillment and logistics operations, it still plans to expand in the coming years.

The company expanded its fulfillment and logistics infrastructure by 50% in 2020, hiring thousands of drivers, buying trucks and planes, and adding more warehouses. This expansion continued through 2021 and will likely spill over into 2022.

However, outside of expanding its capacity, the company is also investing in and creating new technologies that may automate or improve the logistics and delivery processes, from drone fulfillment to autonomous delivery vehicles.

Patents & new initiatives

Amazon is expanding its logistics infrastructure through a variety of different in-house initiatives. Fulfillment is one important area to improve efficiency.

Amazon has already employed 350,000 robots across its warehousing network, using robotic fulfillment to increase the speed and accuracy of getting online orders filled and ready to ship.

The company has also looked to shopping malls across the US, which are filled with stores that are going out of business or closing brick-and-mortar locations, to increase fulfillment square footage. In 2020, Amazon was in talks with the largest mall owner in the US, Simon Property Group, to convert old department stores into fulfillment locations.

Although there have been no updates on the Simon Property Group talks, Amazon has already converted out-of-business malls in Cleveland, Ohio, to act as fulfillment warehouses, according to the Wall Street Journal.

Source: WSJ

When it comes to mid-mile and last-mile delivery — getting the customer orders from warehouses to their final location — Amazon has a few initiatives in the works.

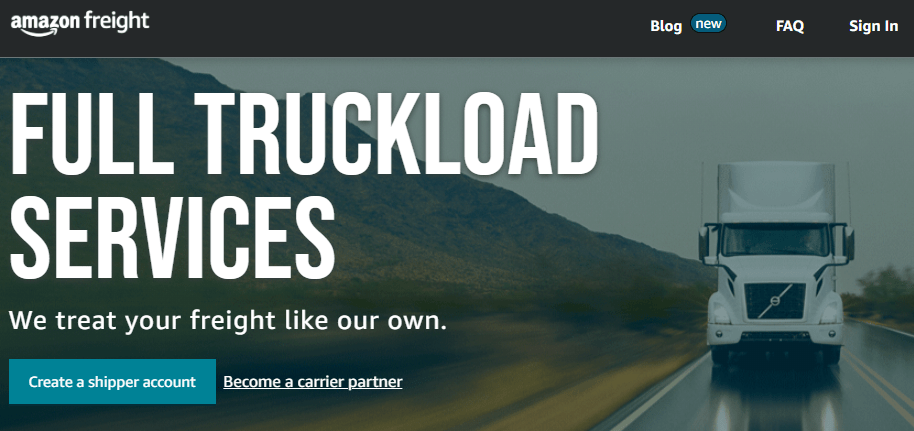

Freight matching: Freight matching platforms have risen to prominence for efficiently matching shippers with available carriers, facilitating partnerships between verified players, and providing pricing transparency.

In May 2020, Amazon launched its new digital freight matching platform across the continental US. The announcement is significant because it may allow Amazon to use its scale to gain greater control over the mid mile freight market, strengthening its position as a major shipper.

Source: Amazon Freight

As Amazon establishes its freight matching capabilities for third-party shippers, it may leverage its scale to offer below-market rates to shippers and competitive rates to truckers — drawing business away from competing platforms. In fact, it announced a new initiative to lease Amazon-branded trucks to small trucking companies, according to The Information.

The Amazon Freight Partners (AFP) program provides delivery partners with business training, loans and other forms of support. Partners are responsible for hiring drivers and managing their work. Each participant partners exclusively with Amazon to move goods between warehouses and delivery stations by following predetermined routes, and participants are paid at set rates. They can use their own trucks, but Amazon also offers a lease option that includes maintenance, a truck replacement, and repairs. Amazon hoped that the program would increase the number of its delivery partners to 285 in 2021, up from 100 in 2020.

Driver shortages have created challenges for the AFP program in the US. Nevertheless, Amazon expanded it to 5 countries in Europe at the end of 2021.

Autonomous last-mile delivery: Last-mile delivery, or the final leg of the supply chain, is complex and highly inefficient. In fact, last-mile delivery accounts for 53% of total shipping costs. Since consumers have grown to expect free shipping, retailers and logistics providers are increasingly eating these costs.

Amazon and others are investing in innovative ways to cut costs and increase speed of last-mile delivery.

For example, in early 2019, Amazon launched “Scout Delivery,” an autonomous delivery service in select areas. In July 2020, the service expanded into Atlanta, Georgia, and Franklin, Tennessee. Just a year later, Amazon announced plans to open a Scout Development Center in Finland. The center will work on developing 3D technology to improve the robot’s safety. Amazon’s fleet of autonomous electric devices are about the size of a cooler, and navigate sidewalks to deliver select products to Amazon Prime customers.

Source: Biz Journals

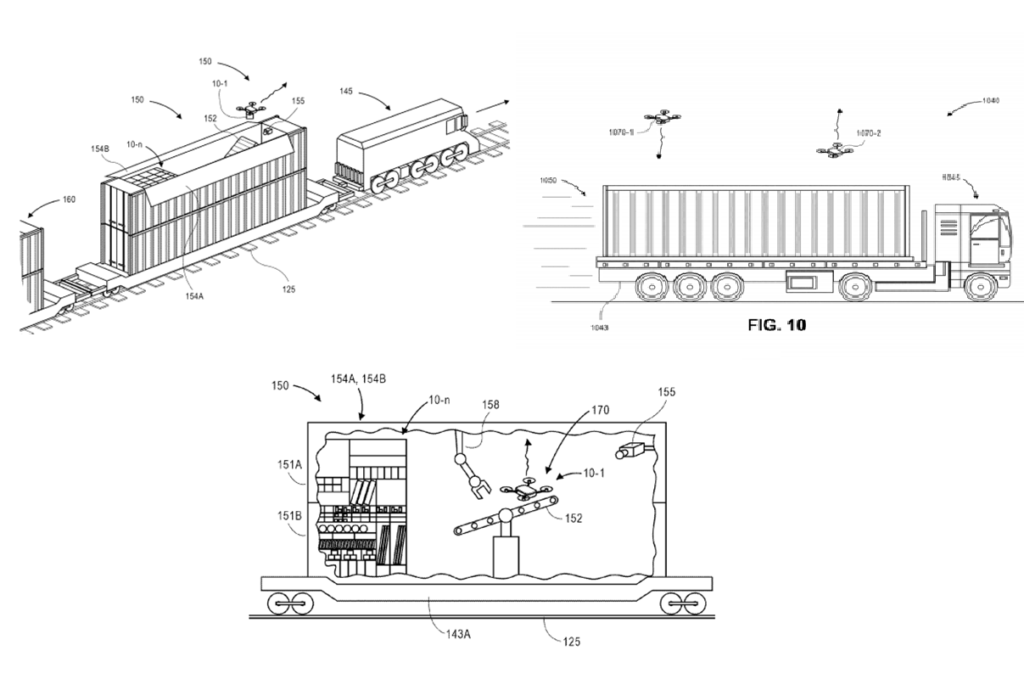

Further, one of the technology giant’s patents, for “mobile fulfillment centers with intermodal carriers and unmanned aerial vehicles,” describes a system for combining drone delivery and automated fulfillment.

Source: USPTO

Expanding its logistics network: Outside of its investments in technology to improve the speed and costs of fulfillment and delivery, Amazon is spending significant amounts of money to expand its existing logistics infrastructure.

For example, the company expanded its logistics square footage by 50% in 2020. It also announced the expansion of its Amazon Air capabilities in February 2019, including 50 planes and a $1.5B hub in Kentucky, which opened in August 2021.

The tech company also expanded its own last-mile delivery network, inviting individuals to develop their own fleets of Amazon vans through a Delivery Service Partner program that launched in 2018. As of August 2020, the program has reportedly created 85K jobs across 1.3K small businesses, delivering 1.8B packages.

However, there have been concerns surrounding the pace and speed required by these independent contractors to stay on as Amazon partners, including a poor environment for employees and aggressive daily targets that incentivize risky behavior. A North Carolina-based delivery partner is now suing Amazon over setting unattainable goals and misrepresenting the earnings potential of the program.

Investments & partnerships

Amazon is acquiring and investing in upstart transportation companies to build out its own transportation ecosystem.

For example, Amazon acquired self-driving tech developer Zoox for $1.2B in June 2020, aiming to expand its auto portfolio. The retailer also invested in autonomous driving developer Aurora Innovation, with the goal of building out autonomous vehicles for logistics.

Outside of autonomous driving, the company invested in and partnered with EV truck maker Rivian. The startup is working on delivering 100,000 electric vans to Amazon by the end of 2024.

Amazon also partnered with autonomous trucking startup Embark in 2019 to transport goods along an interstate highway, aiming to reduce reliance on physical drivers and increase efficiency.

To enhance its robotic fulfillment capabilities, Amazon acquired CANVAS Technology, a robotics company building autonomous carts for moving goods within warehouses and developing outdoor delivery robots in April 2019.

WHO’S AT RISK

Delivery companies

Amazon’s logistics ambitions clearly bring the retail giant in direct competition with its current delivery partners, including private companies like UPS, DHL, and the US Postal Service (USPS).

Amazon’s shipping partners have benefitted from the retailer’s massive order volumes for years, but those revenues are coming under threat as Amazon builds out its own delivery capabilities. The USPS made $1.6B in profit or $3.9B in revenue in 2019 from Amazon alone, accounting for less than 10% of the USPS total annual revenue. Amazon also represents roughly 13% of UPS sales, while FedEx canceled its relationship with the big tech company in August 2019 after disclosing that Amazon contributed only 1.3% of the company’s total revenue.

If Amazon continues to expand its logistics network, it is estimated that the company could reduce last-mile delivery costs by $2B to $6B, according to RBC Capital Markets. This incentivizes Amazon to continue to reduce its reliance on third-party shippers.

Supply chain & logistics startups

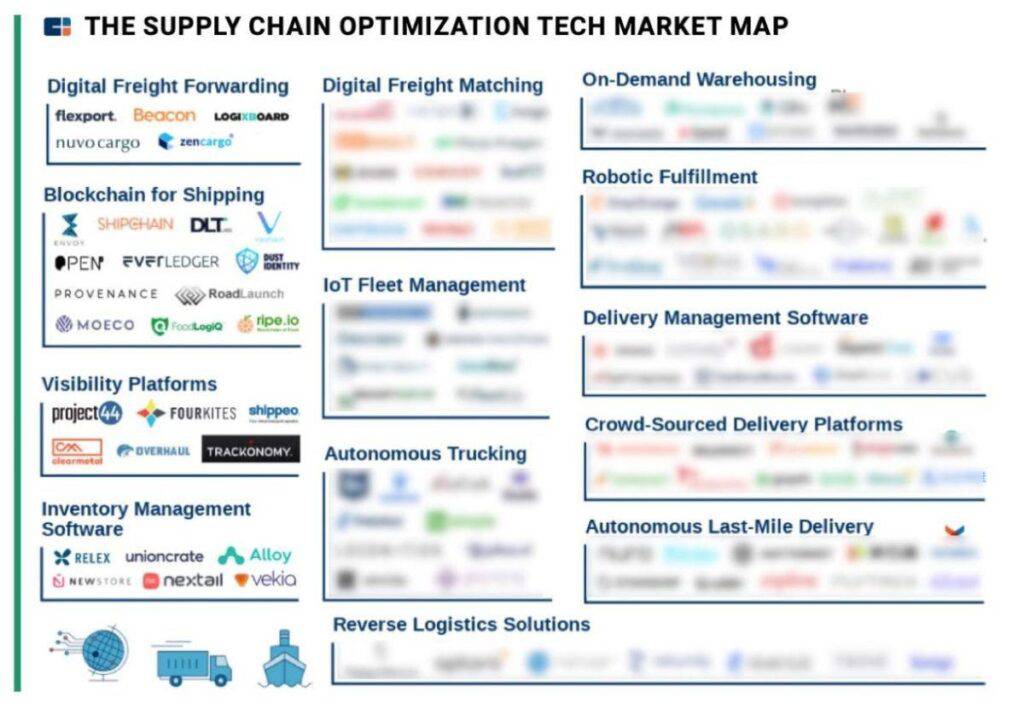

If Amazon continues to develop its logistics capabilities and then begins to offer these services to outside retailers, supply chain startups may suffer.

There is a wealth of logistics companies that each target a small portion of the supply chain, from digital freight forwarding to inventory management to autonomous delivery.

CB Insights clients can see the full supply chain optimization tech market map here.

If Amazon bundles many of these functions into 1 product, many of these companies could be at risk.

However, funding to supply chain startups reached record highs in 2021, with $41B in funding across 789 deals, highlighting that investors still believe the market opportunity is robust.

Other major retailers

Major brick-and-mortar retailers are also at risk, as Amazon’s logistics plays further embed the company in consumers’ daily lives while retailers struggle to catch up with the requirements of online fulfillment & delivery.

Walmart, for example, is building out its logistics infrastructure and capabilities amid the Covid-19 crisis, as it also seeks to reach consumers where they are — at home. The company launched a direct competitor to the Amazon Prime membership, called Walmart+, which provides users with free unlimited delivery, discounted fuel pricing, and mobile checkouts, for nearly $100/year. As of September 2021, 32M American households use the service.

Source: Walmart

Unlike Amazon, Walmart is mainly focused on growth through partnerships rather than in-house development or investments. In August 2020, the retailer announced a partnership with Instacart to pilot same-day delivery services in select US markets.

Other retailers are also expanding online commerce options, as customers are now more likely to purchase from retailers that offer curbside pickup or omnichannel services.

That being said, Amazon has decades of experience and deep pockets, giving the company a significant advantage against its competitors, many of which are just now looking to grow fulfillment and delivery capabilities.

4. Online groceries and digitized stores: Changing the way customers grocery shop

In 1998, Jeff Bezos and his biggest VC advocate, John Doerr, began investing in promising dotcom startups trying to bring the grocery store online. Most would go bankrupt — Wineshopper.com, Homegrocer.com, and delivery service Kozmo.com — but the experience seeded Amazon’s future ambition to dominate the US grocery industry, estimated to be worth about $800B, according to CB Insights’ Industry Analyst Consensus.

A decade later, Amazon would hire 4 former executives from Webvan, a prominent online grocery company and failure of the dotcom era, and set its sights on online grocery again. Today, that project, Amazon Fresh, is delivering groceries from both its own warehouses and Whole Foods stores within 2 hours.

Today, online groceries represent one of the biggest opportunities in retail. Many consumers have embraced online grocery shopping, especially as the Covid-19 pandemic encourages new users to try online grocery delivery to reduce in-person exposure.

Now, supermarket chains all over the country are battling for consumer attention.

Amazon Fresh, the business born out of Amazon’s hiring of 4 former Webvan executives, which merged with Prime Now in 2018.

Traditional grocery retailers are experimenting with new online grocery formats and pricing models as consumers stay home and are more willing to try out different grocery options. However, Amazon may have an advantage over other retailers given its aggressive expansion into the online grocery vertical with a constantly expanding nationwide logistics network and immense spending power.

WHY AMAZON IS GOING AFTER ONLINE GROCERIES

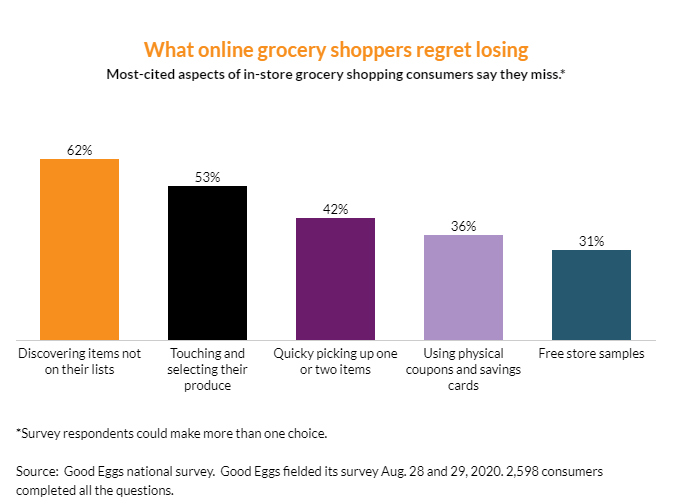

Online grocery sales were steadily increasing before the Covid-19 pandemic, but have since shot up to record levels. Sixty-eight percent of US consumers ordered groceries online at least once during the pandemic, per grocery delivery startup Good Egg, 43% of whom place orders at least twice a month.

While online grocery shopping has expanded significantly over the last several years, its overall penetration in the American market is still relatively low. E-commerce accounted for 9.5% of annual grocery sales in 2021, up from 3.4% in 2019.

One of the biggest challenges facing online grocers is that of keeping costs low both for themselves and for consumers. Margins in the grocery industry are notoriously low, and while typically bringing retail online is a means of increasing margins, there are several reasons why moving grocery selling online has historically been a problem for grocery stores’ revenues.

Storage costs: Online grocers have to maintain expensive investments in storage and distribution facilities, which brings costs up significantly. Perishable foodstuffs must be frozen or refrigerated, meaning that storage facilities are often climate-controlled, which can further increase costs.

Distribution: Owning and maintaining a fleet of delivery vehicles can be costly, as can operating regional distribution centers. As with storage facilities, delivery vehicles must be climate-controlled to preserve freshness of the products. Managing brick-and-mortar grocery stores, by comparison, is relatively inexpensive.

Amazon, however, is uniquely positioned to face these challenges, by virtue of its extensive shipping and logistics networks and its Whole Foods stores — which can act as both shops for in-person shoppers and distribution centers for online grocery shoppers.

One of the other major challenges online grocery retailers must overcome is a consumer preference for in-store shopping. It’s hard to compete with the convenience of online ordering and delivery, yet many consumers still prefer shopping in-store due to the ability to pick their own produce.

Since stay-at-home orders and safety concerns have kept many consumers at home during the Covid-19 crisis, online grocery shopping is the only option available for some.

However, these customers may be tough to retain after the pandemic, as the online grocery experience is still flawed. Consumers say they dislike learning about missing or unavailable items the most, followed by an inability to choose their products themselves.

Source: Digital Commerce 360

Amazon is working on building out machine learning technologies to lower the cost of its services.

Notably, the company has developed an “automated ripeness detection system” that scans fruits and vegetables in its warehouses and cold storage facilities. The algorithm analyzes the fruit or vegetable, determines its high-level quality (e.g., if it’s damaged or expired), and decides whether to throw it away or not. The technology is used by Amazon in Europe and India to supplement a manual inspection practice already being undertaken by associates at AmazonFresh depots. It can reportedly detect spoiled foods with an accuracy of more than 90%.

As mainstream retailers such as Kroger and Target move more aggressively into the online grocery space, it’s likely we’ll see continued investment in and adoption of similar technologies, as retailers seek to close the gap between the in-store shopping experience and its online alternative.

HOW AMAZON IS GOING AFTER ONLINE GROCERIES

Amazon’s $13.7B purchase of organic grocery chain Whole Foods, the company’s largest acquisition to date, raised more than a few eyebrows in 2017.

Some analysts claimed Amazon’s purchase of the retailer was short-sighted, and that Whole Foods’ reputation as a premium retailer — with prices to match — was at odds with Amazon’s low-price, high-volume model.

However, this analysis overlooked a key source of value for Amazon’s acquisition: namely, the potential to use Whole Foods stores as ready-made distribution centers.

With Whole Foods’ 500+ locations across the US, Amazon gained quick access into the highly competitive grocery retail market. Even without its inventory, equipment, and storage facilities, Whole Foods’ physical locations were valuable.

Moreover, many Whole Foods stores are located in affluent urban areas and typically attract higher-income consumers with a preference for high-end grocery products — a similar demographic to that most likely to shop for groceries online, according to a Gallup survey.

Amazon’s grocery initiatives beyond Whole Foods could also give it a leg up in this industry. With 23 locations in the US and more to come, the company’s grocery chain Amazon Fresh (formerly known as Amazon Go Grocery) could give it further brick-and-mortar stores to act as distribution centers. Cashierless technology also provides Amazon with even more granular data about local shoppers’ shopping habits, connecting purchases to individual Amazon accounts. The company also has a chain of convenience stores, Amazon Go.

Amazon has greatly benefited from the Covid-19 pandemic, especially in online grocery. The company’s US online grocery sales increased by 3x year-over-year in the second quarter of 2020 alone, and its grocery delivery capacity grew by 160% in the same time period. Amazon is reportedly on track to double its online grocery sales by 2026.

Even so, the e-commerce giant actually lost market share in the online grocery sector. It commanded around 36% of the American online grocery market in January 2021, down 3 percentage points from October 2020 and dropping below competitor Walmart’s 55% share. When including traditional brick-and-mortar grocers, Amazon’s overall share of the grocery market is still relatively small.

But looking to the future, Amazon still poses a formidable threat, largely because of its significant logistics edge — which can be summarized by 2 broad advantages.

First, Amazon is willing and able to take a financial loss on delivery if it means providing a faster, superior delivery service to consumers that will lead to greater market share in the future.

Second, Amazon’s investments in its logistics infrastructure aren’t limited to its online grocery business; the improvements Amazon makes to its grocery delivery services can be adapted and scaled to other parts of its logistics operations and vice-versa.

DIGITIZED GROCERY STORES

Amazon’s disruption of the grocery industry goes beyond online shopping. In 2020, the company launched Amazon One, palm scanning devices customers can use to pay and verify their identity. It first deployed the devices to Amazon Go stores, but the technology’s use cases extend far beyond supermarkets. For example, employees could use Amazon One devices to enter their place of work.

Dash Cart, the company’s smart shopping cart, also launched in 2020. It automatically identifies items in the cart, allowing the customer to pay for their groceries without interacting with a cashier.

The Dash Cart has had a ripple effect on supermarket chains. Grocery stores Kroger and Albertsons have also introduced smart carts, while grocery delivery service Instacart is investing heavily into smart shopping technology. In October 2021, the company acquired smart cart startup Caper AI for $350M.

Source: Amazon

While competitors are busy developing their own smart cart technology, Amazon is expanding its digitized stores overseas. In the UK, Amazon plans to open 60 new Fresh cashierless grocery stores in 2022 and 100 stores per year in 2023 and 2024. The company is also considering expansion into Spain, Italy, and Germany in 2022. Amazon’s plans seem quite ambitious, considering it opened only 6 stores in the UK in 2021 despite plans to open 26. The rollout of Fresh stores in the US also fell behind schedule in 2021.

In India, Amazon has taken steps to consolidate its online grocery stores. The company has created a unified store Amazon Fresh, integrating once separate supermarkets, Pantry and Fresh. The new store is available in more than 300 cities across the country.

But Amazon’s digitization of the grocery store has also faced criticism, especially regarding biometric data. Because the company is storing Amazon One data in the cloud rather than on the device, there are significant concerns over the security of the users’ palm scans. As additional reasons for concern, US senators have also pointed to Amazon whistleblowers who had come forward about issues regarding data security at the company.

WHO’S AT RISK?

Competing grocery delivery services

Amazon’s immense spending power has allowed the company to compete effectively within the online grocery market from the outset. Amazon currently offers free 2-hour delivery (in select locations) to Prime members on orders that meet the minimum amount. Though traditional retailers like Walmart and other grocery delivery competitors like Instacart aim to price their services similarly to the e-commerce giant, Amazon’s deep pockets may help to undercut delivery prices if the competition continues to heat up.

Amazon is likely to continue pressuring traditional grocery retailers and emerging rivals like Instacart as competition intensifies.

Other supermarket chains

Although the expansion of Amazon Fresh stores is lagging, ambitious goals for 2022 and beyond indicate Amazon’s dedication to its brick-and-mortar grocery stores. Equipped with Dash Carts, its digitized stores have taken grocery shopping to another level, and competitors will need to keep up. The president and CEO of the Independent Grocers Alliance, John Ross, says the shift from traditional checkout registers to cashierless checkout is inevitable. The cashier labor shortage will only expedite the process.

5. Payments: Giving small merchants a cheaper option

Amazon has been building out a presence in the payments space for years, with products including:

- Amazon Pay: Amazon Pay is an integrated payment management system that allows third-party merchants to sell their products on their own sites but use Amazon’s payment tech to receive orders. It also streamlines the payment experience for customers.

- Amazon Cash: Amazon Cash allows consumers to deposit cash without any fee into an online Amazon account by scanning a special barcode at partner retailers.

- Amazon Visa debit/credit cards: Amazon has partnered with Visa to offer a debit card for Prime members and a credit card for non-Prime members. Both offer cash back perks.

- Amazon Reload: This feature allows Amazon Prime members to transfer money from their bank into their Amazon accounts to create a balance. As a reward, 2% of the transfer amount is added to the user’s account right away.

- Amazon Go: Amazon Go is a cashierless convenience store where consumers can simply walk in, grab items off the shelf, and then walk out. The customer’s Amazon account is billed for the purchase when they leave the store.

- Amazon Fresh: This chain of grocery stores uses the same “Just Walk Out” technology as Amazon Go, but shoppers can also use checkout lanes.

- Amazon One: This contactless payment and identity verification service relies on palm recognition.

The logic behind this kind of financial ecosystem is clear — if the company can get consumers to put money into an Amazon-owned account, they will ultimately spend more with Amazon. For example, the Amazon Prime Visa rewards users with Amazon credit.

If Amazon can create a payments channel that’s good for Amazon consumers and saves merchants money, it could have the edge it needs to disrupt the payments industry in a tectonic way.

WHY AMAZON IS GOING AFTER PAYMENTS

When you swipe a credit or debit card at a store, the retailer is charged an additional transaction fee as a small percentage of the overall purchase, also known as an interchange fee. These fees range from 2%–4% per transaction. In 2020, credit card companies earned $51B from interchange fees.

These fees can significantly cut into the bottom line for small businesses, especially if they mostly deal with smaller purchases. But the price isn’t the only factor merchants have to consider when choosing a payment processor — they also need one that doesn’t negatively impact the customer experience.

Especially with the Covid-19 pandemic, adoption of contactless payment options like Apple Pay or Google Pay is rising. By 2025, nearly 60% of consumers worldwide will use mobile wallets.

If Amazon can find a way to make its own payments options stickier, easier for consumers to use, and cheaper for merchants to accept, it could find huge opportunities in this industry.

HOW AMAZON IS GOING AFTER PAYMENTS

Amazon is coming at payments from the perspective of the merchant, who needs a cheaper processing method, and the consumer, who needs a reason to choose Amazon Pay over any other service.

For merchants, working with Amazon means getting access to low fees, Amazon marketing services, and, in the future, easy, one-click access to new tools that capitalize on Amazon’s large member base.

Adopting an Amazon Pay account could allow merchants to experiment with new retail techniques, from cashierless payments to improved targeting to better “buy-online, return-in-store processes.”

On the customer side, the focus is on convenience, speed, and perks that encourage consumers to use their Amazon Pay accounts rather than a debit card.

To make Amazon Pay an attractive option for consumers, Amazon has spent the last several years building additional Amazon financial products and services that complement its value, like Amazon Cash, Reload, and credit cards.

The common theme with all of these products is that they encourage customers to load money onto their Amazon accounts or become more dependent on the Amazon payment system. The more a customer builds up an Amazon balance, the more useful Amazon Pay and Amazon’s other financial features become.

In March 2019, Amazon announced an integration with Worldpay, which serves as a back-end intermediary between banks and credit card companies and is one of the largest payment processors in the world.

It is a notable pivot from Amazon’s IP strategy, where the playbook has been to build, patent, and keep proprietary technology in-house to fuel Amazon’s marketplace. However, keeping Amazon’s customer-centric “day 1” philosophy in mind, Amazon Pay’s top priority is reducing payment friction for customers to buy goods and services and for merchants to sell more things.

Amazon has also taken note of the fast-growing Buy Now, Pay Later (BNPL) market. In 2021, it announced a partnership with Affirm that offers shoppers the option to pay off items in monthly installments. The service is available for purchases that cost $50 or more.

Additionally, Venmo digital wallet users will soon be able to pay for their Amazon purchases using their Venmo account, thanks to a new partnership between the companies. The integration will reportedly be complete in 2022.

Amazon is also partnering with ticketing company AXS to deploy Amazon One palm scanners at an entertainment venue in Colorado. Customers using the scanners will have access to a separate entry line. Amazon and AXS plan to install the system in other venues in the future.

Source: Amazon

Meanwhile, consumers in India can take advantage of the Amazon Pay Later service. So far, 2M customers have signed up to purchase items they can either pay off the following month or over a period of several months. Amazon customers can also use the service to pay utility bills. But the company is not the only one to offer such financial products in the country — Flipkart Pay Later and LazyPay boast 2.8M and 3.5M users, respectively.

WHO’S AT RISK?

Card processors & online payment providers

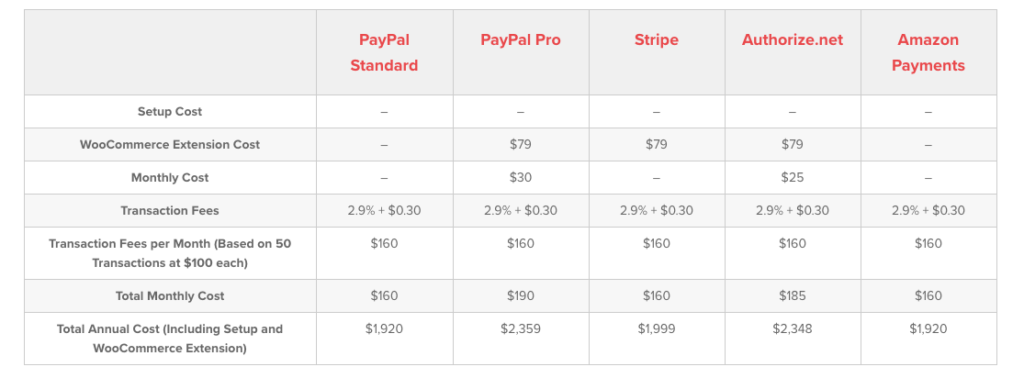

The companies that should be most concerned about Amazon’s ambitions in the payments space are online payment providers like PayPal and Stripe, and card processors like Chase, Visa, and Mastercard.

Today, Amazon Pay’s costs are competitive with other major online payment gateways. With its 2.9% transaction fees and $0.30 authorization, Amazon comes in right alongside PayPal Standard when it comes to annual costs.

Source: CodeinWP

Amazon can differentiate itself with its access to data about a merchant’s customers and its ability to offer new kinds of marketing. PayPal and Stripe do not have a wealth of information about what customers are buying or how they’re buying it — and that’s information Amazon can use to make sure its payments products are more valuable than others.

Global payments competitors

Amazon’s push into payments has been global.

Internationally, the company has been especially focused on countries with large unbanked populations and high growth e-commerce markets.

In India, Amazon’s main competitors in payments are Google Pay, PhonePe, and Alibaba-backed Paytm.

In 2018, Amazon launched bill pay through Amazon Pay in India. It also spent $40M acquiring app aggregator Tapzo, primarily to increase Amazon Pay usage by making it a default payments scheme for customers in certain apps.

Amazon has an advantage over other startups and banks in international markets and domestically because it doesn’t need to drive a profit from transaction fees — and subsequently doesn’t need to cut deeply into merchants’ margins. In many cases, it may even be able to help merchants drive revenue.

This is because Amazon benefits from activity taking place in Amazon Pay wallets, as well as the resulting upward trend in Amazon spending. This is why Amazon’s presence in payments needs to be taken seriously, and why the mounting spread of the Amazon Pay button is the best signal yet that disruption in payments is coming.

For more on Amazon’s financial services strategy, see our report Everything You Need To Know About What Amazon Is Doing In Financial Services.

The 7 industries Amazon could go after next

6. Insurance: Bundling value into the shopping experience

Amazon has already shown some interest in building out its own insurance business.

In 2016 it launched Amazon Protect, a UK service that provides accident and theft insurance on products sold through Amazon.

A 2017 product manager job listing in Amazon’s EU Product Insurance group hinted that the company had definite designs in the insurance space: “We have ambitious plans to significantly grow operations in our current markets and create new, innovative products that will provide excellent customer experience and satisfaction.”

In 2018, it confirmed an investment in the India-based startup Acko, which primarily works on car and bike insurance policies. In September 2018, Amazon made its interest in the insurance market in India even clearer when it filed with the country’s Registrar of Companies to begin selling its own health, life, and general insurance products. In March 2019, Amazon received its corporate agent license from the Insurance Regulatory and Development Authority of India, clearing the way for the company to proceed further.

Amid the Covid-19 pandemic, Amazon began offering cost-free health insurance to its sellers in India, with Acko handling the policies, claims, and reimbursement.

In September 2019, Amazon rolled out a pilot for Amazon Care, a healthcare service for its employees in the Seattle, WA area. On the Amazon Care app, patients can set up virtual doctor’s appointments, home visits (depending on location), and also schedule Covid tests. Amazon recently expanded the virtual service to its workers and other employers regardless of their location in the US. The company plans to launch in-person services in over 20 cities in 2022.

Amazon is also helping its sellers purchase product liability insurance for protection in case their merchandise causes injury to a customer. The company requires all sellers who generate more than $10,000 in sales in one month to have liability insurance. On the Amazon Insurance Accelerator marketplace, sellers can buy coverage from established and startup providers. Merchants based in China can also invest in product liability insurance through Amazon’s partnership with insurance company Marsh.

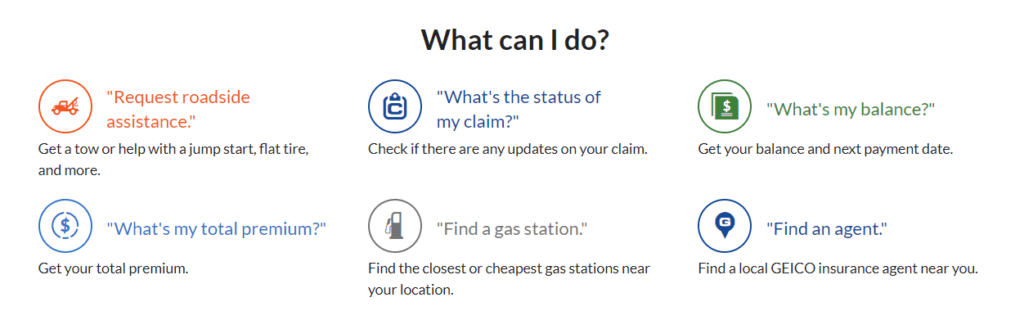

For home and auto coverage, Amazon has partnered with leading insurers like Geico and Allstate to build Alexa skills that provide policy information and quotes to current and prospective customers. The company has also partnered with Travelers to offer its home insurance customers a free Echo Dot device.

Source: Geico

Whether offering home insurance, product insurance, or car insurance, Amazon could use its size as an e-commerce retailer and its huge member base to become a major distributor in the United States.

Amazon’s strong brand and customer trust could make Amazon Insurance a highly attractive option for customers — especially Prime customers — looking for a more valuable insurance offering. The interest is certainly there, considering a recent survey showed that 55% of consumers would buy insurance from Amazon.

7. Luxury goods and services: Bringing high fashion online and digitizing beauty salons

Amazon has already taken on the world of fashion, selling clothes, shoes, and accessories on its platform, but recently it has turned its focus to a new category — luxury goods.

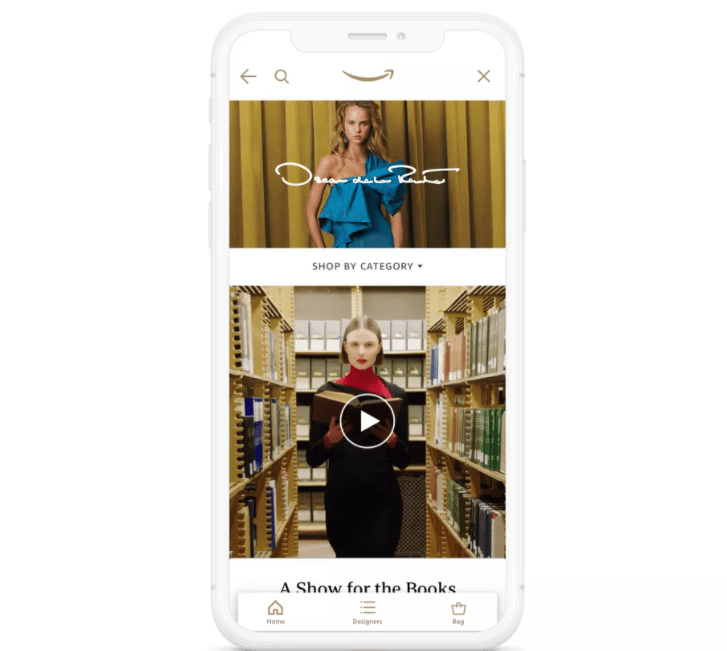

In September 2020, the retail giant launched a “Luxury Stores” function to try to entice high-end brands to sell on its platform. The store is only available for select customers on the Amazon mobile app, and initially partnered with only Oscar De La Renta. Since then, 9 brands have joined Luxury Stores, including Elie Saab and Roland Mouret. The service also expanded to Europe in 2021.

Source: Vogue

Even though Amazon is giving brands more power and freedom than it would on its regular digital storefront, and more than luxury brands could see with traditional department stores, some companies are hesitant to bite.

For example, luxury conglomerate LVMH has already commented that it won’t list its products on Amazon, mainly due to the proliferation of third-party counterfeits on the Amazon platform.

Though Amazon may not become the premier luxury marketplace any time soon, its wide breadth of paying Prime members and deep pockets means the company has an opportunity to provide luxury brands with exposure, marketing, and a new sales channel.

Meanwhile, in 2021, Amazon branched off into beauty services with the launch of a hair salon in London. Hair consultations at the Amazon Salon use AR technology to let customers test different looks before making a decision. For a complete branded experience, the salon is equipped with Fire tablets to provide entertainment during appointments. Amazon has also integrated shopping into the experience, and clients can browse haircare products and order them directly from Amazon by scanning a QR code.

Source: Amazon

Upon launch, the salon was available only to Amazon employees, but the company opened it to all customers shortly after.

However, Amazon’s foray into hair salons has more to do with testing new technology and promoting products rather than becoming a serious contender in the salon business space. Currently, it has no plans to launch additional salons.

8. Brick-and-mortar retail: Launching Amazon Style

In January 2022, Amazon announced the launch of a physical store called Amazon Style. The first location will reportedly open later this year in Los Angeles.

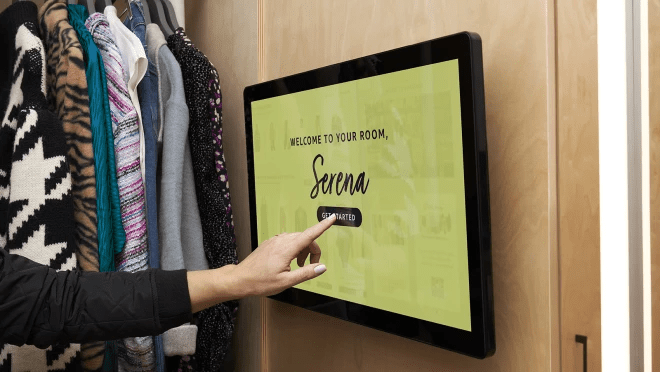

The Amazon Style store is connected to the Amazon Shopping app, which customers can use to select garments to try on or purchase. The fitting rooms feature touch screens that allow shoppers to explore garments, rate them, and request additional styles and sizes.

Source: Amazon

Amazon has designed the shopping experience to be, above all, convenient. Every item of clothing comes with a QR code that shoppers can scan to see size availability and other details, so there’s no need to comb through clothing racks. Consumers will also enjoy special deals and personalized product recommendations.

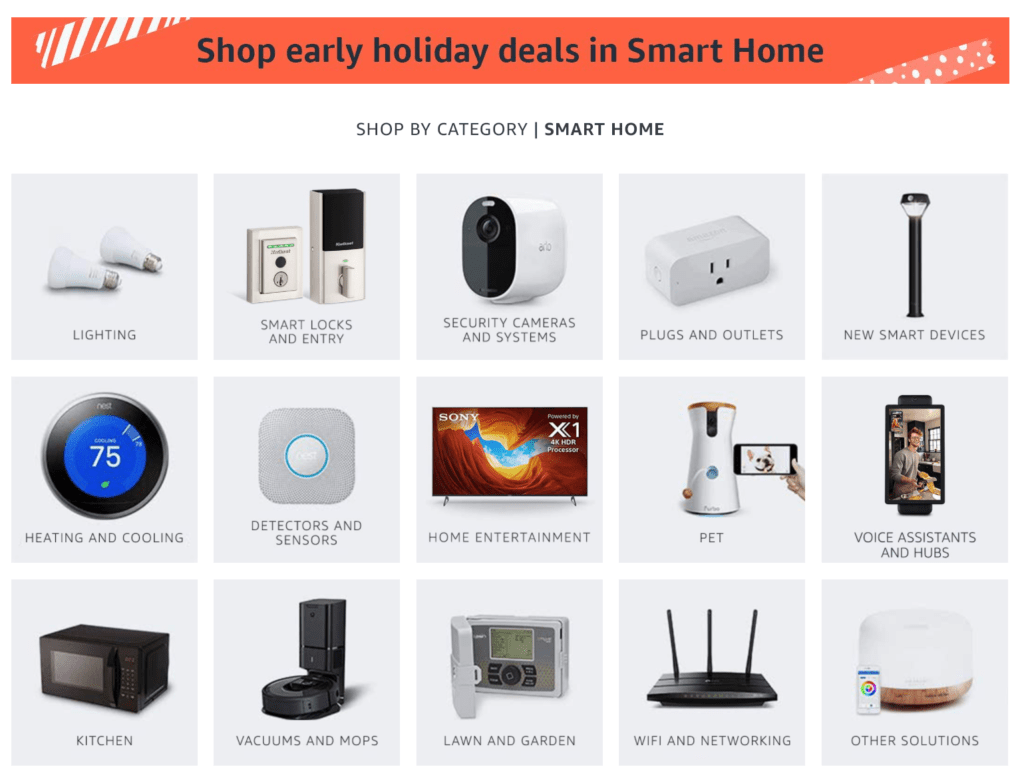

9. Smart home: Racing to connect the whole house

Amazon has significant ambitions in the smart home industry, though the market has been slow to take off and likely won’t become a full reality for years.

Amazon has long set its sights on dominating the smart home market, and launched its first smart home product — the Amazon Echo smart speaker — in 2014. Many competitors like Google Home or Sonos have gained traction since then, but Amazon still held 69% market share of the smart speaker market as of August 2021.

However, the smart speaker is only the start of a complete smart home.

Smart houses bring connected devices into many aspects of home living, from heating to lighting to kitchen appliances. Since 2018, Amazon has been rolling out Amazon-branded smart devices that integrate the Alexa voice assistant capabilities, from microwaves to clocks.

Source: Amazon

Many smart home systems are not interoperable — in other words, they don’t work with other products from outside systems. Smaller, cheaper appliances and items — such as smart locks — allow Amazon to get customers more comfortable with Amazon-branded smart products while also ensuring that customers stay within the Amazon universe when looking to build out a connected home.

In 2018, the retailer partnered with Lennar, one of the largest home construction companies in the US. New Lennar homes offer built-in smart home capabilities powered by Alexa, from thermostats to doorbells.

Amazon has also invested in about 30 smart home-related deals through its Amazon Alexa Fund, and has acquired smart home companies including:

- Doorbell and smart camera startup Blink for $90M in 2017

- Connected doorbell Ring for $1B in 2018

- Wi-Fi mesh network startup Eero in February 2019

The number of smart home appliance users in the US is expected to more than double to reach 64M by 2025. With these acquisitions, Amazon is preparing to win big as the market takes off.

10. Home & garden: Capitalizing on supply chain expertise

When Amazon launched its Plants Store in early 2018, the garden sector was wrestling with a change in attitudes across the industry. But Amazon had strong evidence that its logistics and distribution expertise could make gardening a profitable niche for the company to grow into.

Many younger consumers, particularly first-time homeowners, view gardening as a product or service rather than the leisurely, long-term pastime of older generations. Generally, younger consumers want plants, but don’t have the time to devote to keeping difficult plants alive. They also often prefer to order plants online rather than visit a nursery in person.

Especially amid the Covid-19 pandemic, plants have become a way for some to experience nature while stuck indoors or while unable to travel. In fact, garden retail was one of the top industries experiencing growth amid the pandemic, with sales increasing by 8.6% year-over-year in spring 2020.

Online companies like The Sill and Bloomscape have successfully carved out a space in the home & garden industry by making the plant selection process less risky. They primarily sell plants that are hardy and easy to keep alive, include detailed care information, and offer a money-back guarantee on plants that die soon after purchase.

But the challenges of shipping plants — along with rapidly changing climates, ongoing changes in water restrictions, and heightened demand for hardier plants — have made the home & garden sector more difficult for smaller, brick-and-mortar operations and online-first startups to navigate successfully.

The Sill ships nationwide from its own warehouse and shipping facility, which is crucial for maintaining quality control when it comes to shipping plants with specific needs.

When Amazon launched its Plants Store in 2018, it gave consumers the ability to sort plants by a range of criteria, including size, type, climate zone, and even the amount of sunlight required for optimal growth. Source: Amazon

Amazon could expand its footprint in gardening by using its warehouse network, nascent brick-and-mortar network, and massive advantage in the supply chain to make buying and selling plants online more convenient for its associated merchants.

Amazon’s acquisition of Whole Foods and emerging conventional grocery chain could be powerful leverage in disrupting the gardening space.

And with 110 fulfillment centers nationwide, Amazon’s superior logistics infrastructure could pose an existential threat to traditional home and garden centers.

Amazon can continue to apply pressure on incumbent plant suppliers by directly appealing to younger, more convenience-focused consumers who continue to see gardening as an extension of their lifestyle.

11. Media & entertainment: Expanding into the gaming and audio markets

Video games represent a $211B market, according to CB Insights’ market sizing tool. Amazon has already entered the fast-growing market through acquisitions and launching a gaming subscription service.

In 2014, Amazon acquired video game live streaming platform Twitch for $970M. At the time, the platform had 55M visitors per month. But by 2020, it boasted 30M daily visitors who tune in to more than 7M streamers. The pandemic spurred Twitch’s rapid growth, and it has expanded to offer non-gaming content as well. The platform now hosts 91% of all streamed content, making Amazon an undisputed leader in the live streaming space.

Amazon also launched a cloud-based subscription gaming service called Luna in September 2020. Users can play a variety of games for a monthly fee of $5.99. The company has launched Luna controllers. However, the service is still in the early access phase, so users who sign up must wait for Amazon to give them access to the Luna platform.

Source: Amazon

Amazon faces strong competition in the cloud gaming market. Microsoft’s Xbox Game Pass service recently passed the 25M subscriber mark and is constantly expanding its portfolio of games. But not all tech giants have found success in the gaming market. Stadia, Google’s cloud gaming service, struggled to turn a profit after launch. Recent reports claim Google has demoted the project and will instead focus on using the technology as a white-label service.

In addition to gaming, Amazon is investing in audio. In August 2021, reports surfaced that claim Amazon Music is building out a live audio feature that would host artist performances, podcasts, and radio shows. The company plans to incorporate the feature inside Twitch as well.

Amazon also acquired podcast network Wondery in 2020 for an undisclosed sum, a move that shows its dedication to the audio streaming industry. Today, the company is the largest investor in the audio business, surpassing Spotify. Although Spotify is the streaming platform with the highest market share, Amazon Music is growing faster than its Sweden-based rival.

12. Handcrafted goods: Amazon Handmade takes on Etsy

In 2015, Amazon launched Handmade, a store for handcrafted goods to take on the $680B handicrafts market. Since then, it has seen a 20x increase in product selection and a 7.5x increase in the number of sellers who come from over 80 countries.

Source: Amazon

Despite the success of Handmade, its chief competitor Etsy is still performing well in the market. The number of active sellers has grown steadily over the years. Thanks to the explosion of e-commerce in 2020, the number reached 4.3M, up from 2.7M the previous year.

However, Etsy has also increased the fees sellers pay on the platform through an Offsite Ads program. With Offsite Ads, Etsy will run online ads on behalf of merchants. If a customer clicks and makes a purchase, the seller will pay a 12%–15% fee in addition to standard fees. Offsite Ads are only optional for sellers earning less than $10,000 per month.

Amazon Handmade requires merchants to sign up for a seller account that costs $39.99 per month, in addition to fees, and then sign up for Handmade. Once Amazon approves the application, the merchant will no longer have to pay the monthly fee — only a 15% fee for every sale.

Even though Handmade offers fewer categories than Etsy, merchants can benefit from Prime shipping and a big consumer base. Considering 63% of sellers reach profitability within their first 12 months on Amazon, we can expect Amazon Handmade to continue attracting merchants who want to bring their handcrafted products in front of a large audience.