Link to the original article: State of Retail Tech Q1’22 Report

After a record 2021, global retail tech deal activity and funding cools in Q1’22.

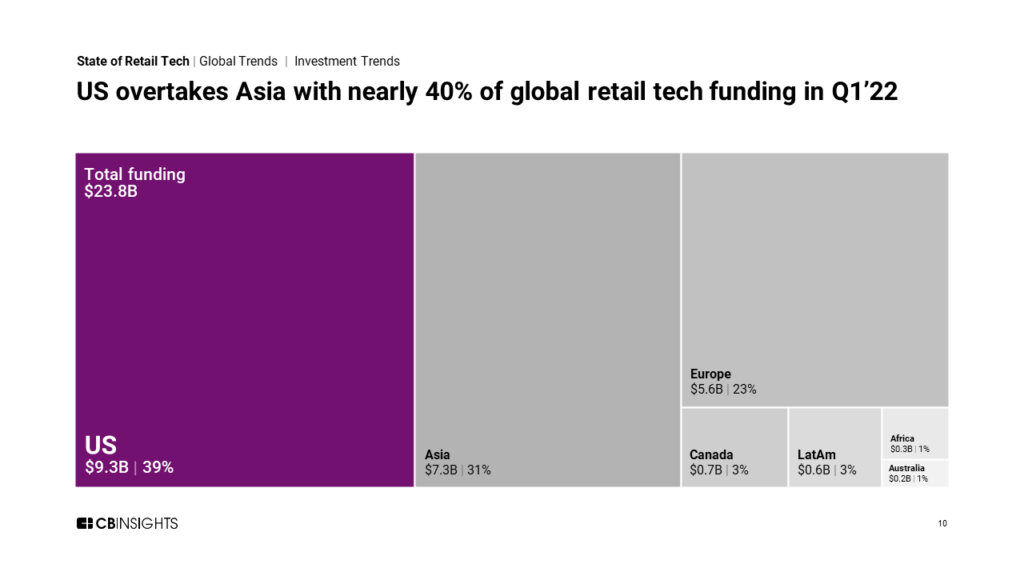

Global retail tech funding reached $23.8B in Q1’22, down 11% quarter-over-quarter (QoQ). Despite the slowdown, Q1’22 funding remained higher than any quarter before Q1’21.

In our State of Retail Tech Q1’22 Report, we dig into global investment trends to spotlight takeaways like:

- The regions seeing growth — or declines — in their share of global retail tech deals and funding

- Which sector made up nearly half of all new unicorns in the quarter

- The investor that funded the most companies in Q1’22

- Which segment of retail tech is driving the hot M&A market

- Which companies boosted store management tech funding by 10%, the highest increase across retail tech sectors

- The sector that drew $4 out every $10 retail tech venture dollars in Asia

- And much more

Below, check out a few highlights from our 190-page, data-driven State of Retail Tech Q1’22 Report. For deeper insights, all the record figures, and a boatload of private market data, download the full report.

US TAKES FIRST PLACE

See which companies and deals boosted the US into first place, ahead of Asia, in share of global retail tech funding.

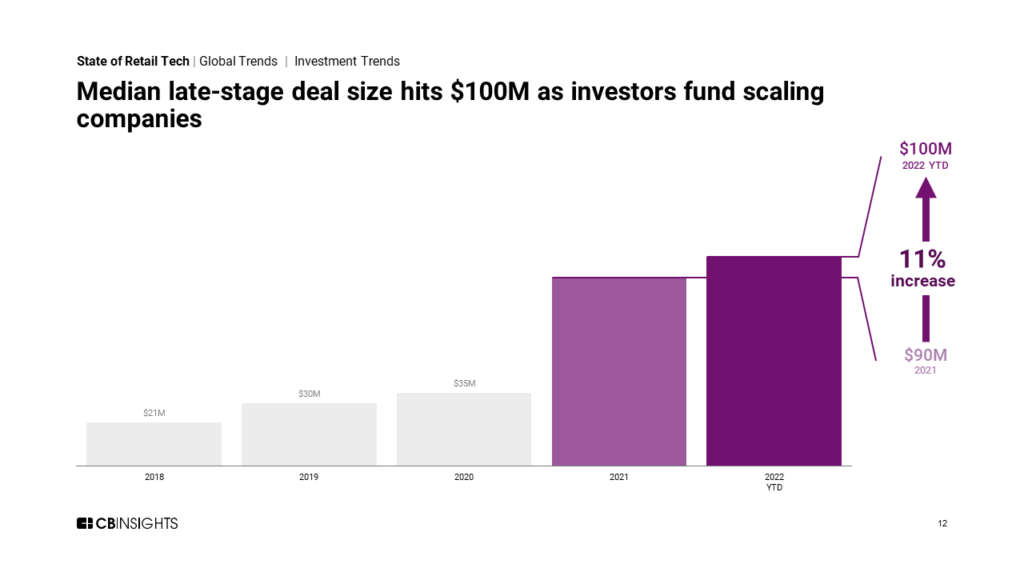

FUNDING POURS INTO LATE-STAGE COMPANIES

Find out which sectors and companies are driving continued increases in the median late-stage deal size.